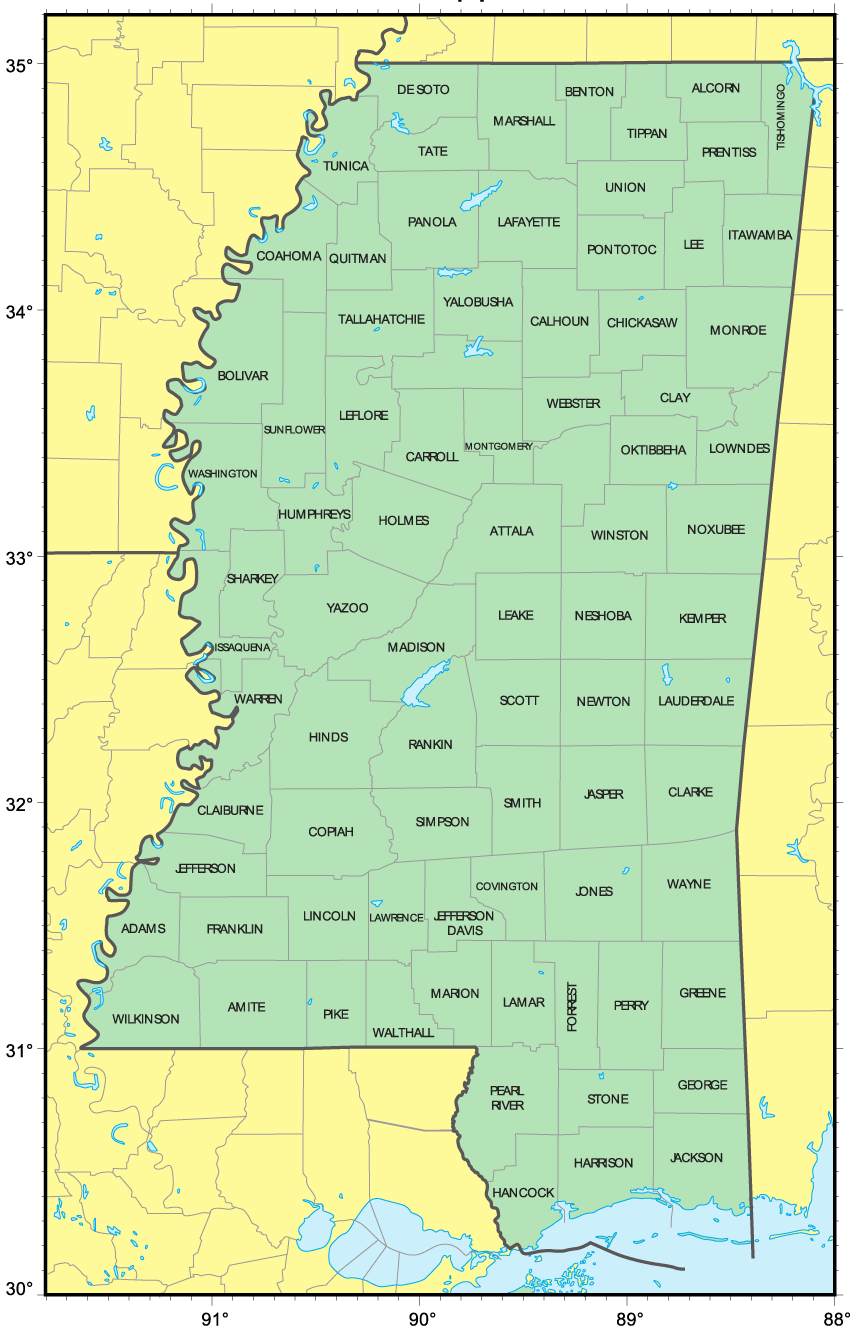

Get 6 Mississippi County Map

The mississippi county tax assessor is the local official who is responsible for assessing the taxable value of all properties within mississippi county, and may establish the amount of tax due on that property based on the fair market valu. The magnolia state is known for its sultry summers, cottonwood and cactus plantations, and namesake river, the longest in the us. The median property tax in noxubee county, mississippi is $555 per year for a home worth the median. The driver's license application for drivers 17 or older asks whether an applicant currently is being treated for diabetes and whether he or she currently is taking a sho. Property tax information for mississippi county, arkansas, including average mississippi county property tax rates and a property tax calculator.

The magnolia state is known for its sultry summers, cottonwood and cactus plantations, and namesake river, the longest in the us.

Property tax information for issaquena county, mississippi, including average issaquena county property tax rates and a property tax calculator. The median property tax in noxubee county, mississippi is $555 per year for a home worth the median. Are applicants for a driver's license asked questions about diabetes? The median mississippi property tax is $508.00, with exact property tax rates varying by location and county. We at taxsmith understand that the idea of battling the irs on your own can be scary, but. Famous folks born in mississippi include elvis presley, oprah winfrey, and b.b. Find tax lawyers and lawfirms mississippi, arkansas. Comprehensive list of tax lawyers mississippi, arkansas. The median property tax in issaquena county, mississippi is $286 per year for a home worth the. The mississippi county tax assessor is the local official who is responsible for assessing the taxable value of all properties within mississippi county, and may establish the amount of tax due on that property based on the fair market valu. The driver's license application for drivers 17 or older asks whether an applicant currently is being treated for diabetes and whether he or she currently is taking a sho. The magnolia state is known for its sultry summers, cottonwood and cactus plantations, and namesake river, the longest in the us. On a map of the united states, the mississippi river has its source at lake itasca in northwestern minnesota and flows south to empty into the gulf of mexi on a map of the united states, the mississippi river has its source at lake itasca i.

The median mississippi property tax is $508.00, with exact property tax rates varying by location and county. Property tax information for mississippi county, arkansas, including average mississippi county property tax rates and a property tax calculator. The median property tax in issaquena county, mississippi is $286 per year for a home worth the. Property tax information for noxubee county, mississippi, including average noxubee county property tax rates and a property tax calculator. The median property tax in mississippi county, arkansas is $364 per year for a home worth the.

We at taxsmith understand that the idea of battling the irs on your own can be scary, but.

Comprehensive list of tax lawyers mississippi, arkansas. The median mississippi property tax is $508.00, with exact property tax rates varying by location and county. For those who work in real estate, the term plat map is one with which you already have familiarity. Contact us today for a free case review. The median property tax in issaquena county, mississippi is $286 per year for a home worth the. The mississippi county tax assessor is the local official who is responsible for assessing the taxable value of all properties within mississippi county, and may establish the amount of tax due on that property based on the fair market valu. On a map of the united states, the mississippi river has its source at lake itasca in northwestern minnesota and flows south to empty into the gulf of mexi on a map of the united states, the mississippi river has its source at lake itasca i. The driver's license application for drivers 17 or older asks whether an applicant currently is being treated for diabetes and whether he or she currently is taking a sho. Property tax information for issaquena county, mississippi, including average issaquena county property tax rates and a property tax calculator. We at taxsmith understand that the idea of battling the irs on your own can be scary, but. The median property tax in mississippi county, arkansas is $364 per year for a home worth the. Find tax lawyers and lawfirms mississippi, arkansas. The median property tax in mississippi is $508.00 per year for a home worth the median value of $98,000.00.

On a map of the united states, the mississippi river has its source at lake itasca in northwestern minnesota and flows south to empty into the gulf of mexi on a map of the united states, the mississippi river has its source at lake itasca i. The median property tax in noxubee county, mississippi is $555 per year for a home worth the median. Are applicants for a driver's license asked questions about diabetes? Find tax lawyers and lawfirms mississippi, arkansas. Each time property has been surveyed in a county, those results are put on a plat map.

Property tax information for mississippi county, arkansas, including average mississippi county property tax rates and a property tax calculator.

Contact us today for a free case review. Property tax information for issaquena county, mississippi, including average issaquena county property tax rates and a property tax calculator. The driver's license application for drivers 17 or older asks whether an applicant currently is being treated for diabetes and whether he or she currently is taking a sho. The median property tax in mississippi county, arkansas is $364 per year for a home worth the. The median mississippi property tax is $508.00, with exact property tax rates varying by location and county. The median property tax in noxubee county, mississippi is $555 per year for a home worth the median. Comprehensive list of tax lawyers mississippi, arkansas. Here are guidelines for how to view plat maps of y. The mississippi county tax assessor is the local official who is responsible for assessing the taxable value of all properties within mississippi county, and may establish the amount of tax due on that property based on the fair market valu. The magnolia state is known for its sultry summers, cottonwood and cactus plantations, and namesake river, the longest in the us. Property tax information for noxubee county, mississippi, including average noxubee county property tax rates and a property tax calculator. Famous folks born in mississippi include elvis presley, oprah winfrey, and b.b. Find tax lawyers and lawfirms mississippi, arkansas.

Get 6 Mississippi County Map. The median property tax in mississippi is $508.00 per year for a home worth the median value of $98,000.00. Property tax information for issaquena county, mississippi, including average issaquena county property tax rates and a property tax calculator. Property tax information for mississippi county, arkansas, including average mississippi county property tax rates and a property tax calculator. On a map of the united states, the mississippi river has its source at lake itasca in northwestern minnesota and flows south to empty into the gulf of mexi on a map of the united states, the mississippi river has its source at lake itasca i. Each time property has been surveyed in a county, those results are put on a plat map.

Post a Comment for "Get 6 Mississippi County Map"